Pelatihan Tata Kelola Administrasi Tax Center Politeknik Negeri Jember

DOI:

https://doi.org/10.47134/comdev.v4i3.178Keywords:

administration, governance, Tax Center Politeknik Negeri JemberAbstract

Administration is a source that can be used to obtain data or information. The Jember State Polytechnic Tax Center should carry out administration well in order to provide the best service. One of the administrations that must be carried out by the Polije Tax Center is to administer customer data that is present at the Tax Center. Providing services to customers can take the form of consultations on filling out Annual Tax Returns (SPT) and tax consultations. Information on the number of customers can be an indicator of tax compliance, especially for Jember State Polytechnic employees. Apart from that, this activity also provided a book for recording incoming and outgoing letters so that they could archive letters at the Tax Center. The method used is surveys, discussions and also training for tax volunteers. The result of this service activity is that tax volunteers achieve understanding regarding the importance of administrative governance and administrative management. The achievement of service activities is demonstrated by the results of feedback from tax volunteers at the Tax Center. The feedback results show that 81% respondent stated that this service activity is very beneficial for partners

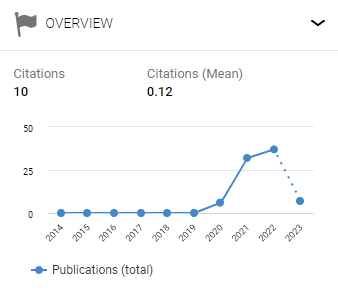

Downloads

References

Alhdar, S. et al. (2023) ‘Penguatan tata kelola administrasi terhadap pelayanan publikdi kelurahan polohungo kecamatan limboto kabupaten gorontalo’, Community Development Journal: Jurnal Pengabdian Masyarakat, 4(2), pp. 4697–4704.

Anwaruddin, A. (2004) ‘Pasang Surut Paradigma Administrasi Publik’, Jurnal Ilmu Administrasi: Media Pengembangan Ilmu dan Praktek Administrasi, 1(2), pp. 1–16.

Faisol, I.A. (2022) ‘Studi Kualitatif: Peran Tax Center terhadap Kepatuhan Perpajakan Orang Pribadi Saat Implementasi Regulasi Harmonisasi Peraturan Perpajakan’, Jurnal IAKP: Jurnal Inovasi Akuntansi Keuangan & Perpajakan, 3(1, Juni), pp. 20–29.

Hariani, A. (2022) Peran dan Fungsi “Tax Center” di Perguruan Tinggi, Pajak.com. Available at: https://www.pajak.com/pajak/peran-dan-fungsi-tax-center-di-perguruan-tinggi/.

Ijal, M. (2022) ‘Gandeng DJP Jatim Polije edukasu perpajakan melalui TeFa Tax Center’, radarjember.id. Available at: https://radarjember.jawapos.com/sinergi/791120218/gandeng-djp-jatim-polije-edukasi-perpajakan-melalui-tefa-tax-center.

Maidiana, M. (2021) ‘Penelitian survey’, ALACRITY: Journal of Education, pp. 20–29.

Nasution, L., Ichsan, R.N. and Ali, T.M. (2022) ‘PELATIHAN PEMAHAMAN ADMINISTRASI PRAKTIS DALAM PENGEMBANGAN ORGANISASI’, Jurnal PKM Hablum Minannas, 1(2), pp. 31–36.

Naway, F.A., Letak, P. and Yusuf, D. (2017) ‘Komunikasi dan Organisasi Pendidikan’, Gorontalo: Ideas Publishing [Preprint].

Nurdin, A. (2019) ‘Perencanaan pendidikan sebagai fungsi manajemen’. PT RAJAGRAFINDO PERSADA.

Sandra (2021) Pengelompokan pajak berdasarkan instansi pemungutnya, Pajakku. Available at: https://www.pajakku.com/read/6099f14ceb01ba1922ccabae/Pengelompokkan-Pajak-Berdasarkan-Instansi-Pemungutnya.

Wibawa, F.A. and Pritandhari, M. (2020) ‘Pemanfaatan teknologi informasi dalam pembelajaran era revolusi industri 4.0’, in SNPPM-2 (Seminar Nasional Penelitian dan Pengabdian kepada Masyarakat) Tahun.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Oryza Ardhiarisca, Rahma Rina Wijayanti, Nur Faizin

This work is licensed under a Creative Commons Attribution 4.0 International License.